The financial industry faces a unique set of challenges. Sure, employee engagement, knowledge management, and internal communications are up there, just like any other industry. However, financial institutions are also some of the most heavily regulated. Data security, risk management, and ever-changing regulatory compliance requirements are daily challenges. It’s a fast-paced, dynamic environment that requires agility and flexibility to stay ahead of the curve. That’s where a finance intranet comes in.

Whether you are a finance business, credit union, or other financial institution, a financial intranet delivers operational efficiency, data security, and compliance requirements. Under one virtual roof are all the tools you need to provide exceptional customer service and maintain a competitive advantage.

- What Is A Finance Intranet?

- Top 6 Benefits Of A Finance Intranet

- Finance Intranet Essential Features

- Financial Intranet: Real-World Examples

- MyHub’s Financial Intranet

Today’s blog discusses why a financial intranet is a must-have platform for financial institutions of all shapes and sizes. We explore all the benefits and essential features and end by sharing some real-world examples to inspire and motivate you.

Ready to get started? Let’s dive right on in.

What is a Finance Intranet?

A finance intranet platform is a secure private network accessible only to your employees. It supports seamless collaboration, streamlined communication, and effortless document management in a safe digital environment. It provides a central location for:

- Customized Workflows: Task automation, secure document sharing, and project collaboration

- Internal Communications: Improving employee communications through company news feeds and,social intranet features such as shoutouts and company alerts

- Knowledge Management: Provides a central platform that fosters knowledge management and information between finance professionals

- Boosting Control & Security: User authentication and role-based permission down to file and page level ensure data security quality control and compliance

Benefits of a Finance Intranet:

- Centralized Information And Document Management

- Improved Knowledge Sharing

- Streamlined Cross-Departmental Collaboration

- Enhanced Internal Communication

- Increased Productivity

- Enhanced Customer Service

Who Can Benefit from a Finance Intranet?

Any organization that relies on financial data and processes can benefit from a finance intranet.

Top 6 Benefits Of A Finance Intranet

Want to know the difference a financial intranet can make to financial professionals? Check out the following top six benefits.

Centralized Information And Document Management

Your financial intranet is the single source of truth for company policies, regulatory documents, and industry standards.

A central resource means you minimize the risk of team members accessing incorrect or out-of-date information stored on their PCs or paper files. From the latest compliance regulations to industry requirements or related documents, everything staff need is at their fingertips in a searchable format.

Furthermore, the intranet ensures employees read mandatory content by notifying senior management when content has been accessed. Version control means staff can be confident they are using the most up-to-date information, whether it’s loan approval criteria or account terms and conditions.

And built-in access permissions ensure only those employees who need to can access sensitive data.

Improved Knowledge Sharing

The financial sector is fast-moving with changing market trends, new products, and regulations constantly coming onstream. Knowledge sharing is critical for financial institutions, and intranets make that process a whole lot easier.

Your intranet is the go-to knowledge base for all the latest company information. An online staff directory connects workers to internal experts, and queries are quickly resolved with a DM on team chat. Staff members can follow trending blogs or channels, such as # regulatory changes or # training resources.

Your financial intranet will empower employees with the knowledge and information they need to excel at their jobs. And it will ensure that your people make better, more informed decisions.

Streamlined Cross-Departmental Collaboration

Cross-team working is a feature of financial organizations worldwide. Your finance intranet offers a centralized platform that eliminates silos and brings people together to complete projects.

Furthermore, integration with Microsoft 365 and Google Workspace allows employees to work on documents collaboratively and in real-time within the intranet. A dedicated # channel on team chat means team members can easily share in-the-moment insights and resolve daily workflow queries in no time.

Enhanced Internal Communication

Another fantastic benefit of the financial intranet is seamless communication. Instant messaging, interactive blogs, dynamic news pages, and update feeds keep employees in the loop.

Internal communications are more critical than ever in today’s hybrid workplaces. With an intranet, all workers are involved in the conversation, regardless of the location.

Increased Productivity

When all the right tools are in one central hub, increased productivity is the end result. Your people are not wasting time searching for information or switching between different tools. Instead, they have the time and head space to focus on strategic issues and meeting your customers’ needs.

Enhanced Customer Service

At the end of the day, financial institutions exist to serve their customers. Faster access to information and data ensures your employees deliver superior customer service, giving you an edge over the competition.

Say a customer has a query about lending criteria. Rather than transferring the caller to another department or searching through paper files, the frontline officer can quickly access the relevant information on the intranet, giving the customer informed advice.

Finance Intranet Essential Features

So, what are the must-have features for your financial intranet? Modern intranets have so many features relevant to the finance industry that it’s hard to be selective. However, here are the seven features that every financial intranet must have:

1. Advanced Security Measures

Given the sensitive data financial institutions handle on a daily basis, robust security features are non-negotiable. Your financial intranet must offer secure data storage and access to protect sensitive data from unauthorized access.

Look for a solution with the most up-to-date tools, including end-to-end encryption, multi-factor authentication, access controls, and regular security audits.

2. Customized Workflows

This time-saving tool is a must-have for every financial intranet.

From purchase order requests to automated approvals, create embeddable digital forms for workflows and data collection. The intranet will automatically send digital forms to the relevant team member for action. Much faster than any manual process, digital workflows are also less prone to human error.

3. Employee Engagement Features

Recruitment and retention are pain points for the financial industry, just as they are for other sectors. Ensure your intranet platform keeps employees engaged with an intuitive, personalized user experience. Easy navigation is a must.

Furthermore, intranet surveys and polls are the perfect tools to gather insights and feedback from your people. They give workers an internal voice and demonstrate how much you value their input.

Other essential employee engagement tools include interactive blogs and social features, such as comments, likes, and follows.

In addition, motivate employees with shoutouts on team chat, employee recognition programs, and news stories highlighting the achievements of staff inside and outside the workplace.

4. Advanced Search

Financial institutions handle vast amounts of data, so look for a solution that delivers rapid, accurate search results.

Make sure your financial intranet has a robust search function based on keywords, tags, authors, and topics. You want accurate results delivered in nanoseconds.

5. Customization Features

Look for an intranet solution that you can make your own. Enrich your financial intranet with full color, font, image, logo, and CSS customization.

Reflecting your branding in the intranet gives it a familiar look and feel, helping to drive adoption.

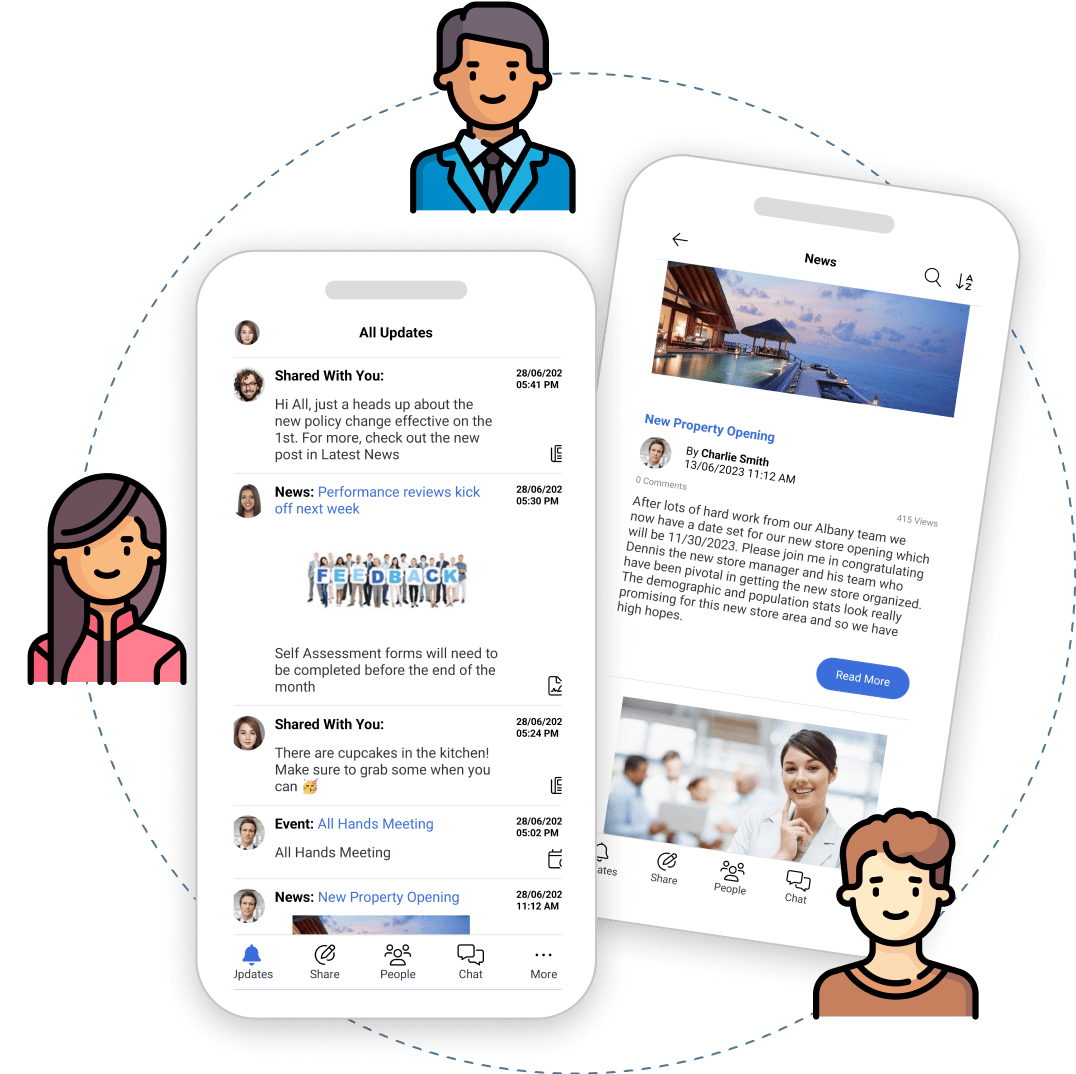

6. Mobile App

According to Deloitte, 66 percent of senior management in financial services work remotely or in hybrid arrangements. Nowadays, a mobile intranet is essential.

However, a mobile-friendly version isn’t enough. You need a dedicated mobile app with the same rich functionality as the desktop version. That way, your remote and on-the-go users can stay connected, informed, and, most importantly, productive.

Furthermore, a mobile app can help combat those feelings of isolation and loneliness that remote and on-the-road workers often experience. Something as simple as the # watercooler channel on team chat can help foster social bonds and a sense of community.

7. Seamless Integration With Enterprise Systems

No doubt, your financial institution uses a broad range of enterprise apps. It could be CRM software, HR and payroll platforms, or accountancy software like MYOB.

Make sure your financial intranet integrates with the software you already have. Most modern intranets offer seamless integrations for streamlined data exchange and workflows. No more switching between different screens and logins. Instead, the intranet is a gateway into your digital workplace.

8. Performance Metrics

After investing all that time and effort into your financial intranet, you want to ensure it hits the mark.

Look for a platform with built-in analytics. The user data is invaluable in helping you understand what works and what could be improved. Metrics will help you make informed decisions about content, features, tools, and strategies so the platform keeps on delivering.

Financial Intranet: Real-World Examples

Looking for some inspiration to get started? Check out the following real-world examples of how financial institutions use their intranet platforms.

Enhanced Collaboration

A credit union uses the intranet to enhance collaboration by allowing employees to collaborate on documents in real time, track task progress, and share insights. Pain points and bottlenecks are minimized as employees stay connected regardless of their location.

Real-Time Communication

In the ultra-dynamic financial sector, a mortgage brokerage uses the intranet to get critical information out super-fast, such as market updates or changing interest rates. All-staff emails can sit unread in in-boxes for days, whereas a hot news alert on the intranet homepage or instant message ensures time-sensitive messages get through.

Knowledge Sharing And Professional Development

An insurance company prioritizes knowledge sharing and professional development for its financial intranet. Policy management and version control are simplified as staff access only the latest information. Employees share knowledge and expertise through interactive blogs, @ mentions, # channels, and trending topics. And employee profiles make it easy for workers to identify internal experts and connect with knowledge.

The insurance company’s financial intranet is also the go-to resource for training materials and internal or external professional development opportunities. And because training and development are key drivers of employee engagement, this company has seen a welcome boost in the number of engaged workers.

Regulatory Compliance And Governance

All financial institutions face stringent regulatory requirements. Intranet platforms help you stay on top of compliance with an organization-wide governance framework, ensuring all records and actions align with industry regulations.

MyHub’s Financial Intranet

MyHub’s financial intranet will help your financial institution overcome the various challenges it faces. Your people will love using our super easy-to-setup and manage software. Vital information is at the fingertips of employees, exactly when they need it.

Our software ticks all the boxes for the must-have financial intranet features. Here are just some of the outstanding features that make our software the preferred intranet for financial services companies:

- Over 60 integrations with enterprise systems

- Specialized mobile app

- 60+ pre-built templates

- Instant messaging

- Personalized updates feed pulling notifications and updates from across the site

Explore these features and much more in our features video above, a free demo, or a 14-day no-obligation trial.